Integrating payment methods into your business is an important decision. So in this post, I will be discussing using multiple payment gateways and their benefits for making the customer checkout process easy and convenient.

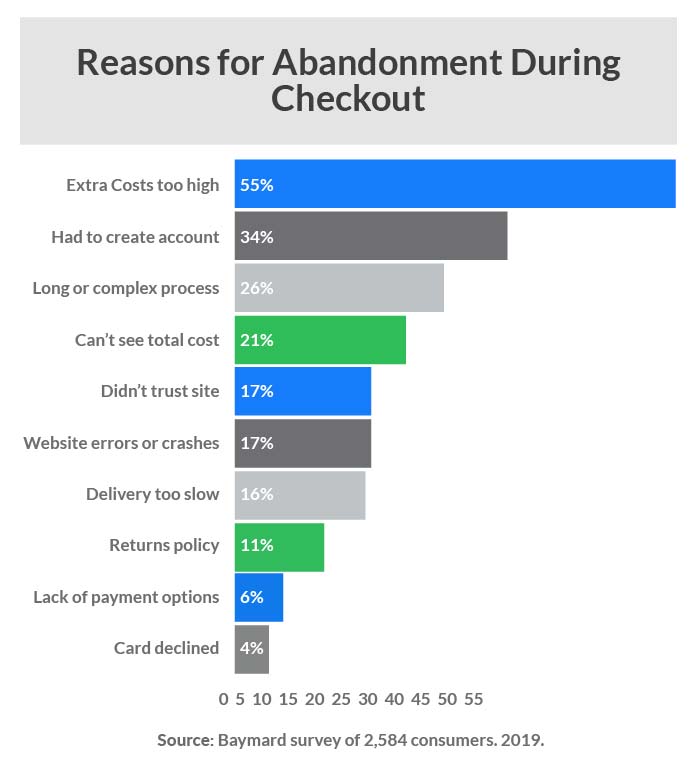

Multiple payment gateways help simplify the process and keep customers coming back for more. Surveys of shopper habits from Baymard Institute indicate that, on average, 6% of customers cancel or abandon their orders if they are unable to find a convenient payment option or if the checkout process is not simple.

CloudBanking Payment Processor is one API that supports simultaneous use of multiple payment gateways, which is used to segment payment processing for different vendors and customers.

Multiple Payment Gateway- What is it? How does it Work?

In a competitive business market, the payment processor with multiple payment gateways is an effective tool for any merchants. With the diverse payment methods, the customers will easily deal with all purchases; therefore, they can boost sales effectively. For online Business or in-store Business, merchants can add any third-party provider to receive payments from customers.

By adding multiple payment gateways, the merchants can have many advantages for their shops. It can directly help to boost the customer’s shopping experience through the support of the payment process. Moreover, via the checkout process, the merchants can provide multiple ways to meet their customer’s needs and solve issues in purchasing. Multiple payment gateways help increase your business conversion rate and are an important tool to back up sensitive data when the default gateway is out of order.

CloudBanking payment gateway provides access to 150+ multiple payment gateways with its Multi Plexing feature. Via Multi Plexing, you can ensure ongoing compliance even when the regulations change and avoid technical resource drain of the system. It is followed by a simple sign-up process on the CloudBanking portal and configure with one or more payment gateway. It is that simple. You can easily set up multiple gateways and switch in seconds to avoid any failures at the time of customer onboarding. Accept payments via any Cards (Credit Cards, Debit Cards), Direct Debit, and digital wallets like Apple Pay, Amazon Pay and Google Pay. Moreover, you can even collect offline payments via bank transfer and physical terminals.

Benefits of multiple payment gateways

Multiple payment gateways offer a ton of benefits that help make your business more profitable. Here are a few of them:

Customer Convenience

Multiple payment gateways help your customer to provide a convenient checkout process. If customers are not able to find their preferred payment method, they will abandon their shopping carts. However, smart Merchants are moving towards using multiple payment gateways and creating convenience for customers by supporting the need for various payment options. They even realized the advantage of supporting mobile payments as a recent study revealed that online sales via smartphone in the U.S. is estimated to grow at an annual rate of 18% over the next few years.

CloudBanking Payment Solution has the mobile app feature, designed especially for mobile wallets and mobile payment apps. Thus, it is required for merchants to take advantage of this trend and offer at least a few payment gateways that provide the convenience of mobile shopping and digital payment options.

Perceived Data Security

Encrypting customer data and transmitting it securely is one of the key features of a payment gateway. Therefore, make sure that your payment gateway is PCI compliant before sign up.

Rather than having actual data security, having multiple payment gateways creates a sense of perceived security for your business and customers. According to a survey done by YouGov, 40% of online customers felt more secure buying from a store with multiple payment methods. Therefore, having multiple payment gateways is a sign to your customers that you are trustworthy. The more payment gateways you use, the higher the level of trust and legitimacy.

Cost Optimization

With access to multiple payment gateways, your customers can split their single payment into multiple payment processors based on currency or transaction amount.

If you plan to sell your business products or services worldwide, having a single payment gateway could cut you off from an enormous market. Thus, if you want to expand your business in an international market, multiple payment gateways help you handle different currencies. It is not only convenient for you but your customers as well, as they can purchase products and services in their local currency. Then with the help of multiple gateways, you can seamlessly convert your currency into local and make the checkout process more convenient.

Optimize Cash Inflow

Route Payment helps in processing transactions at the most appealing fees and highest acceptance rates. Along with failover protection, it helps to minimize declines and ensure all transactions are processed optimally. Customers have various conditions while making payments. So the more payment partners you have, the more of your business needs are covered.

Failover Protection

Imagine it is the EOFY sales period, and you are in the middle of a record-breaking sales run. Suddenly, your payment gateway crashes, and you miss hundreds of dollars in your sales. Well, a payment gateway crash can happen at any time. But with multiple payment gateways, you are all safe to make sales at any time. If one crashes, you can funnel customers into another. It is an easy way to avoid vendor migration as it also records a backup of your customers’ data. When a customer makes a payment, your payment gateway records their information to easily process any future purchases. Having multiple payment gateways divides the data among them, so you won’t lose it if data is deleted or destroyed.

Why Choose CloudBanking for Plexing?

It could not be smart to rely on a single payment partner as not any payment processor is immune to outages and downtimes. It could be a critical situation for many growing businesses if downtime incurs and impacts both financial and reputational. Integrating multiple payment solutions helps you to avoid this risk and ensure operational continuity.

CloudBanking Multi-Plexing allows you to offer support for various payment methods while enabling customers to pay in their preferred currency. It makes your business flexible with a high potential for expanding globally. With CloudBanking Multiplexing, you can:

- Add any payment provider you want. CloudBanking is Integrated with 150+payment gateway worldwide, thus obtain access and send payments anytime, anywhere.

- Ensure On-Going Compliance when your primary processor is down and provide the best possible experience on your customers’ payment journey.

- Think beyond an integrated payment solution. We provide the technical infrastructure and building connections to protect sensitive data from any third party.

CloudBanking helps you to integrate multiple payment gateways and establish connections with APIs of payment providers. With a single integration with us, get access to 150+ provider and ensure security and stability in business.

'

'